Most of our clients charge their overseas clients the gst and include it in the price but sometimes we need to add or separate out NZ GST for WooCommerce products.

Recently 1 client asked for it to be on New Zealand purchases only, here’s how you do it.

WooCommerce > General – Enable Taxes

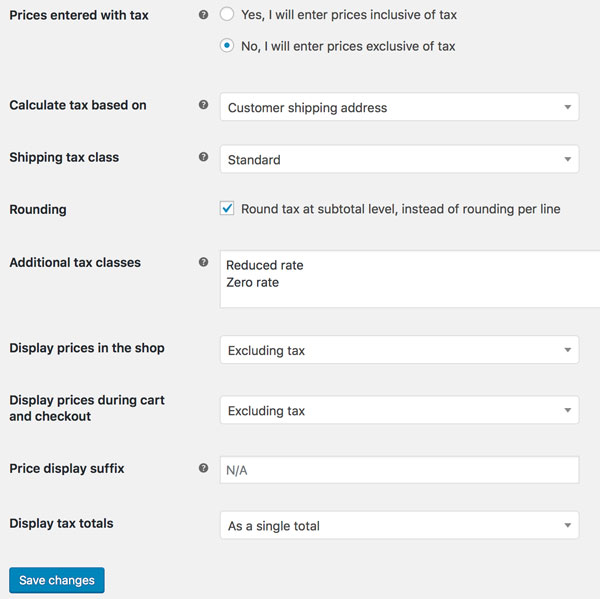

WooCommerce > Tax > Tax Options

Configure the settings…

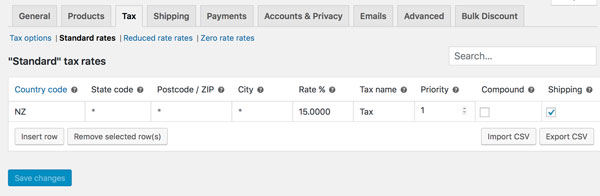

WooCommerce > Tax > Standard Rates

Add the following…

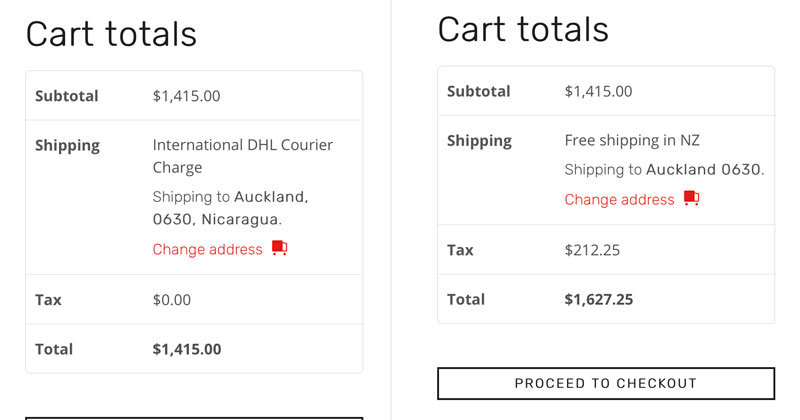

And that’s it. The New Zealand address addition includes the GST of 15%.

The overseas purchase has zero tax.

If you’d like to learn more about how to deal with issues such as tax in Woo-Commerce dont hesitate to get in touch. Woodswork Web hhave been offering services to Woo-Commerce clients since 1999. We can help you with you e-commerce tax requirements.

We set up GST on the following sites:

Now that you have learned how to NZ GST for WooCommerce, need to know more about E-commerce gateways?

There are many, many businesses that offer to receive payments online. Merchant services are provided by most banks but independent companies specialise in online transactions.

Choosing who you will use to provide merchant services is usually based on costs and what is likely to be more cost-effective for your business. This is generally dictated by the number of transactions you will likely have.

You will want to bare these things in mind, as there are various fee options involved that can help you work out the best options for you:

- Set-up fee

- Monthly fee

- Per transaction fee

Competitive rates and investigating the different options

It’s important to know that transaction fees are from your gross sales and not net profit so where you have a 20% profit margin you’ll be giving more than 15% of your gross profit if the fee is 3% of a sale.

Learn more about merchant services in our article. It can point you in the right direction of where to go for merchant services, which services to choose and why they are best for your business.